Monthly performance

March saw rises in both jobs and applications, with a particularly significant rise of 20% in applications. Following a month where both jobs and applications decreased, this is good news indeed. The average application per job number has also increased, from 16 in February to 17 in March.

IT & Internet continues its long-standing reign as the industry posting the largest percentage of jobs and in March it also received the greatest share of applications, overtaking Manufacturing which took the top spot in February.

The majority of jobs in March were posted on Fridays, a day which typically sees far less candidate activity than earlier in the week. Most applications were received on Wednesdays, meaning a huge number of jobs were posted five whole days before the day on which candidates are most active.

In terms of the most active dates of March, most jobs were posted 27th March and most applications were received earlier in the month, on 8th March.

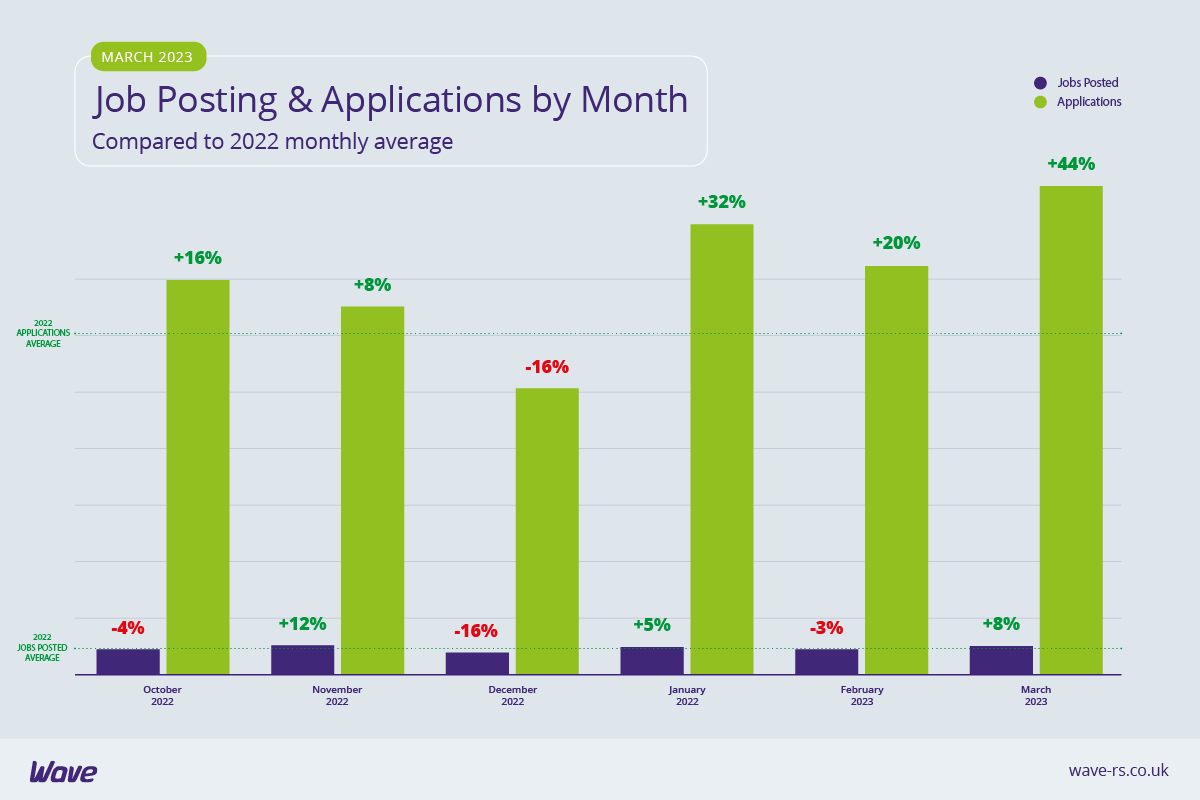

Job posting and applications per month

At a huge 44% over the 2022 monthly average, March saw the highest levels of applications in over a year. Jobs were 8% over the 2022 monthly average, making them the highest they’ve been since November.

March is often an active month in the recruitment industry – in March 2022 we recorded the highest levels of job posts all year and the joint-second highest applications. Whether it’s to do with the financial year coming to a close (and the beginning of a new one, with refreshed budgets, approaching), the start of spring leading people to want to start afresh, or the lack of holidays meaning there are fewer distractions, March can often be a very active month for recruiters.

Industries with most jobs and applications

Not a huge amount has changed in terms of the industries that posted the most jobs and those that received the most applications in March. IT & Internet dominates both for jobs and applications, with Education and Manufacturing also posting large volumes of jobs and appearing in the top 5 for applications.

Health & Nursing and Public Sector & Services, on the other hand, both posted high percentages of jobs but didn’t receive equivalent levels of applications. The opposite is true of Secretarial, PAs & Admin and Engineering & Utilities, which received high levels of applications but didn’t post similarly high levels of jobs.

Average application per job by industry

The average application per job figures on both ends of the scale are higher than they were in February, which explains why the overall average has increased in March. At 35, the industry receiving the highest average numbers of applications per job was Insurance. We’ve mentioned the heightened importance of job security in turbulent times and this could be a classic example of that. During a financial downturn, Insurance is seen as more stable than other industries as, whatever the health of the economy, people and businesses always need protection from risks.

Management Consultancy remains high for average applications, as does Secretarial, PAs & Admin. Finance (another industry with perceived job stability and security) received the fourth highest average application per job numbers, followed by Transport & Logistics, an industry that suffered from skills shortages in late 2021.

Health & Nursing, Not for Profit & Charities, and Education are all still receiving low average numbers of applications per job, at 4, 5 and 6 respectively, although these are higher than in February. Property continues to receive amongst the lowest average application per job numbers, likely due in part to UK house prices falling at their fastest rate since the 2009 financial crisis and activity in the housing market remaining subdued since Liz Truss’ mini-budget. As Property and Construction are intrinsically linked, it is unsurprising that this is also having a knock-on effect on Construction.

Average application per job board

The three job boards receiving the highest average numbers of applications per job in March were all niche – Jobserve, Caterer and Secs in the City. Their numbers were double or even triple the numbers of the second two highest generalist job boards, Reed and CV Library (both of whom received an average of 8 applications per job). With an average of 20 applications per job, Totaljobs received the highest numbers for generalist job boards.

ONS Labour Market Overview: March 2023

As a trusted source, the labour market statistics published by the Office for National Statistics are used to help inform a range of government policies and are heavily used by the recruitment industry as a barometer of the state of the job market.

Vacancies continued to drop in March, falling on the quarter for the eighth consecutive period. The ONS suggests that this reflects uncertainty across industries, as survey respondents continue to cite economic pressures as a factor in holding back on recruitment. However, the number of people in employment has increased, driven by part-time employees and self-employed workers. The unemployment rate rose slightly and the economic inactivity rate dropped again, indicating an increase in people joining or re-joining the job market.

Market snapshot

Why are so many young people not in work or looking for work? This is what Youth Employment UK is asking. The ONS Labour Market Overview for March has shown that there are nearly one million 16-24 year olds who are not in full-time education or employment. The data also shows that the proportion of young people in this group who are economically inactive continues to grow, now accounting for 69.5% of all young people not in full time education or work.