Monthly performance

Following plummeting jobs and applications in April, May figures have risen slightly. Jobs have increased by 17% from April and applications increased by 2%. The gains are small but the downwards trajectory has been halted. The average application per job number remains at the year-low of 13 that we also saw in April, likely due to a continuation of relatively low application numbers.

IT & Internet has regained the top spot for most jobs posted but is second to Secretarial, PAs & Admin this month when it comes to applications.

Most jobs were posted on a Wednesday in May but the majority of applications were received on a Tuesday – an entire week before the flurry of job posting activity.

In a first since we started recording the most active day, in May the day most jobs were posted was the same as the day most applications were received – Monday 22nd May. This could possibly have something to do with a scarcity of working Mondays in May this year. The beginning of the week tends to be when most job and application activity takes place and the 22nd was the only Monday in May that wasn’t a bank holiday.

Job posting and applications per month

From this graph, we can see that, although both jobs and applications rose month-on-month, they are low compared to the average for 2022 and the rest of the year to date bar April. Jobs were 5% below the 2022 monthly average and applications were only just above April’s year-low, reaching 15%. With more bank holidays than usual this May (every Monday bar the 22nd was a holiday), plus a half term with the busiest day at UK airports since before the pandemic, it was a slow month.

Industries with most jobs and applications

Having been knocked off the top spot for jobs by Health & Nursing in April (the first time the industry hasn’t posted the most jobs since December 2021), IT & Internet regained its position as number one in May. Health & Nursing is a close second. Education and Manufacturing are still in the third and fourth spots for jobs, but with Education posting out a huge 62.5% more jobs than it did in April (leaping from 8% of all jobs to 13%).

Secretarial, PAs & Admin have long had an issue with high application numbers but relatively low jobs. It remains the industry receiving the highest percentage of applications in May but it also posted the 5th highest percentage of jobs of all industries, indicating a slight closing of the gap between jobs and applications.

IT & Internet received the second highest percentage of applications, meaning it remains the most active industry when both jobs and applications are considered. Manufacturing also features on both highest jobs and applications charts. Engineering & Utilities, meanwhile, received the fifth highest percentage of applications but doesn’t feature in the most active for jobs chart, indicating there is more demand from candidates than there is supply of jobs.

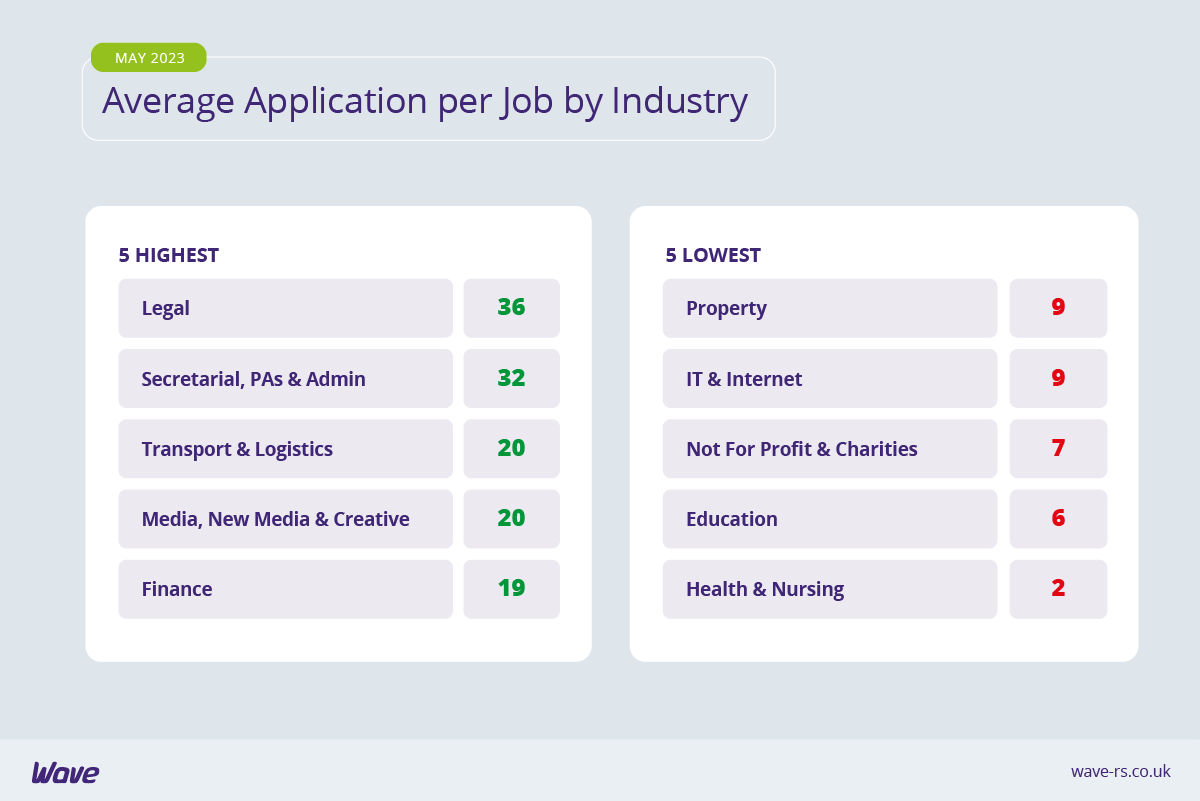

Average application per job by industry

Legal received the highest average applications per job in May, with a huge 36 compared to the general average of 13. Following a close second was Secretarial, PAs & Admin with 32. As the industry also received the highest percentage of applications of all industries this is perhaps unsurprising. Transport & Logistics are receiving a welcome high average number of applications per job following the well-publicised labour shortages towards the end of 2021. On the flip-side, Health & Nursing once again finds itself receiving the lowest average number of applications per job, at just 2. Given the high numbers of jobs it’s posting out, without a corresponding level of applications, this is also unsurprising. IT & Internet makes a surprise appearance in the lowest average applications per job chart, perhaps indicating the sheer volume of jobs that the industry is posting out.

Average application per job board

Niche job boards again received the two highest average number of applications per job, with Jobserve receiving an average of 30 and Secs in the City leaping from an average of 18 in April to 28 in May. Totaljobs received an average of 20, meaning it received the highest average number of applications per job of all the generalist job boards. With an average of 12, Caterer was third for niche job boards and fourth overall, and Reed and CV-Library were fifth and sixth respectively.

ONS Labour Market Overview: May 2023

As a trusted source, the labour market statistics published by the Office for National Statistics are used to help inform a range of government policies and are heavily used by the recruitment industry as a barometer of the state of the job market.

Vacancies fell yet again, by 55,000 on the quarter to 1,083,000 – the 10th consecutive period the number has fallen on the quarter. The UK employment rate rose to 75.9%, driven by part-time employees and self-employed workers. The unemployment rate also rose, largely driven by people unemployed for over 12 months. However, the economic inactivity rate decreased and this was driven by people aged 16 to 14 who are students or inactive for other reasons. Meanwhile, those inactive because of long-term sickness increased to a record high.

Market snapshot

Is long-term sickness holding back recruitment and the economy? With the ONS reporting a record high number of economically inactive people due to long-term sickness, there is surely cause for concern. This is closely linked to the low application numbers and high jobs that Wave records month after month – a critical labour shortage in the industry is a huge contributor to long waiting lists on the NHS, leading to a greater number of people unable to work because of long-term sickness. It seems this is one recruitment area that has turned into a vicious cycle of labour shortages contributing to labour shortages.